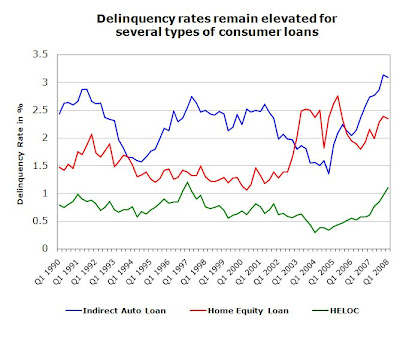

ABA figures show loan delinquencies remain elevated

Every quarter, we get figures on first mortgage delinquencies from the Mortgage Bankers Association. Then a little while later, the American Bankers Association releases delinquency rate figures for several other types of loans -- direct and indirect auto loans, home equity loans and lines of credit, credit cards, and so on. In Q1 2008 ...

* The delinquency rate on home equity lines of credit rose to 1.1% from 0.96% in Q4 2007. That’s the highest since Q1 1997.

* The delinquency rate on indirect auto loans (loans made through dealers, as opposed to a "direct" car loan you might get from a bank) dipped to 3.09% from 3.13%. But that's still the second-worst reading on record for my data, which goes back to 1990. Delinquencies on direct auto loans are also climbing. The DQ rate inched up to 1.92% in the first quarter of this year from 1.9% at the end of 2007 and 1.68% a year earlier.

* The credit card news is also starting to deteriorate. Measured as a percentage of accounts, the bank credit card delinquency rate rose to 4.51% from 4.38%. That's the highest since Q4 2006. Measured as a percentage of total card loan dollars outstanding, the DQ rate rose to 4.59% from 4.5%. That's the highest reading since Q1 2004.

1 Comments:

The delinquency rate on indirect auto loans (loans made through dealers, as opposed to a "direct" car loan you might get from a bank) dipped to 3.09% from 3.13%. But that's still the second-worst reading on record for my data, which goes back to 1990.

By Anonymous, at July 12, 2008 at 5:05 AM

Anonymous, at July 12, 2008 at 5:05 AM

Post a Comment

<< Home