"string theory" and mortgage rates

I want to share a table that I just built with you ...

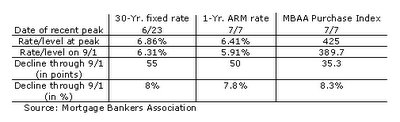

This shows the date that rates peaked on two kinds of mortgages (1-year ARMs and 30-year fixed rate loans). It also shows the week that the Mortgage Bankers Association's purchase mortgage application index peaked. You'll find the levels on those dates, the decline (in basis points and percent for rates, and points and percent for the MBAA index).

This shows the date that rates peaked on two kinds of mortgages (1-year ARMs and 30-year fixed rate loans). It also shows the week that the Mortgage Bankers Association's purchase mortgage application index peaked. You'll find the levels on those dates, the decline (in basis points and percent for rates, and points and percent for the MBAA index).

Anything jump right out at you? Like maybe the fact that an 8%-ish decline in rates has actually been accompanied by an 8%-ish DROP in purchase activity? There should be an INVERSE relatioship between rates and purchases, and so far, there hasn't been.

You've probably heard the expression "Pushing on a string." If you lay a string out on the ground and push one end, the other end doesn't budge. The whole thing just bends out of shape and you make no net progress.

In finance, pushing on a string refers to what sometimes happens in the wake of bursting asset bubbles. The Fed or the bond market can try to fix things (by lowering interest rates). But if borrowers don't want to borrow because they're already up to their eyeballs in debt and/or having trouble making payments ... and if lenders are so buried under bad loans, they don't make NEW credit available ... then the excess money pumping can have little impact.

This is only a nascent trend -- about 8 weeks old. And in the most RECENT week, the MBAA purchase index did pop a couple percentage points. So my "string theory" could prove wrong. But if this continues, expect a lot more trouble in housing land.

This shows the date that rates peaked on two kinds of mortgages (1-year ARMs and 30-year fixed rate loans). It also shows the week that the Mortgage Bankers Association's purchase mortgage application index peaked. You'll find the levels on those dates, the decline (in basis points and percent for rates, and points and percent for the MBAA index).

This shows the date that rates peaked on two kinds of mortgages (1-year ARMs and 30-year fixed rate loans). It also shows the week that the Mortgage Bankers Association's purchase mortgage application index peaked. You'll find the levels on those dates, the decline (in basis points and percent for rates, and points and percent for the MBAA index).Anything jump right out at you? Like maybe the fact that an 8%-ish decline in rates has actually been accompanied by an 8%-ish DROP in purchase activity? There should be an INVERSE relatioship between rates and purchases, and so far, there hasn't been.

You've probably heard the expression "Pushing on a string." If you lay a string out on the ground and push one end, the other end doesn't budge. The whole thing just bends out of shape and you make no net progress.

In finance, pushing on a string refers to what sometimes happens in the wake of bursting asset bubbles. The Fed or the bond market can try to fix things (by lowering interest rates). But if borrowers don't want to borrow because they're already up to their eyeballs in debt and/or having trouble making payments ... and if lenders are so buried under bad loans, they don't make NEW credit available ... then the excess money pumping can have little impact.

This is only a nascent trend -- about 8 weeks old. And in the most RECENT week, the MBAA purchase index did pop a couple percentage points. So my "string theory" could prove wrong. But if this continues, expect a lot more trouble in housing land.

0 Comments:

Post a Comment

<< Home